Special Considerations: If you have employees who work in a state with state-mandated disability or paid medical leave benefits (“State Benefits”)*, they should carefully consider whether to enroll for this coverage. If employees are eligible for State Benefits, they must apply if required by state law. If permitted, your employees’ STD benefit will be reduced by State Benefits or other government benefits that apply. Depending on your employees’ compensation, the amount of the State Benefit, and other factors, they may only receive the minimum weekly benefit. Your employees should consider, based on their individual circumstances, whether they need additional coverage beyond the State Benefit.

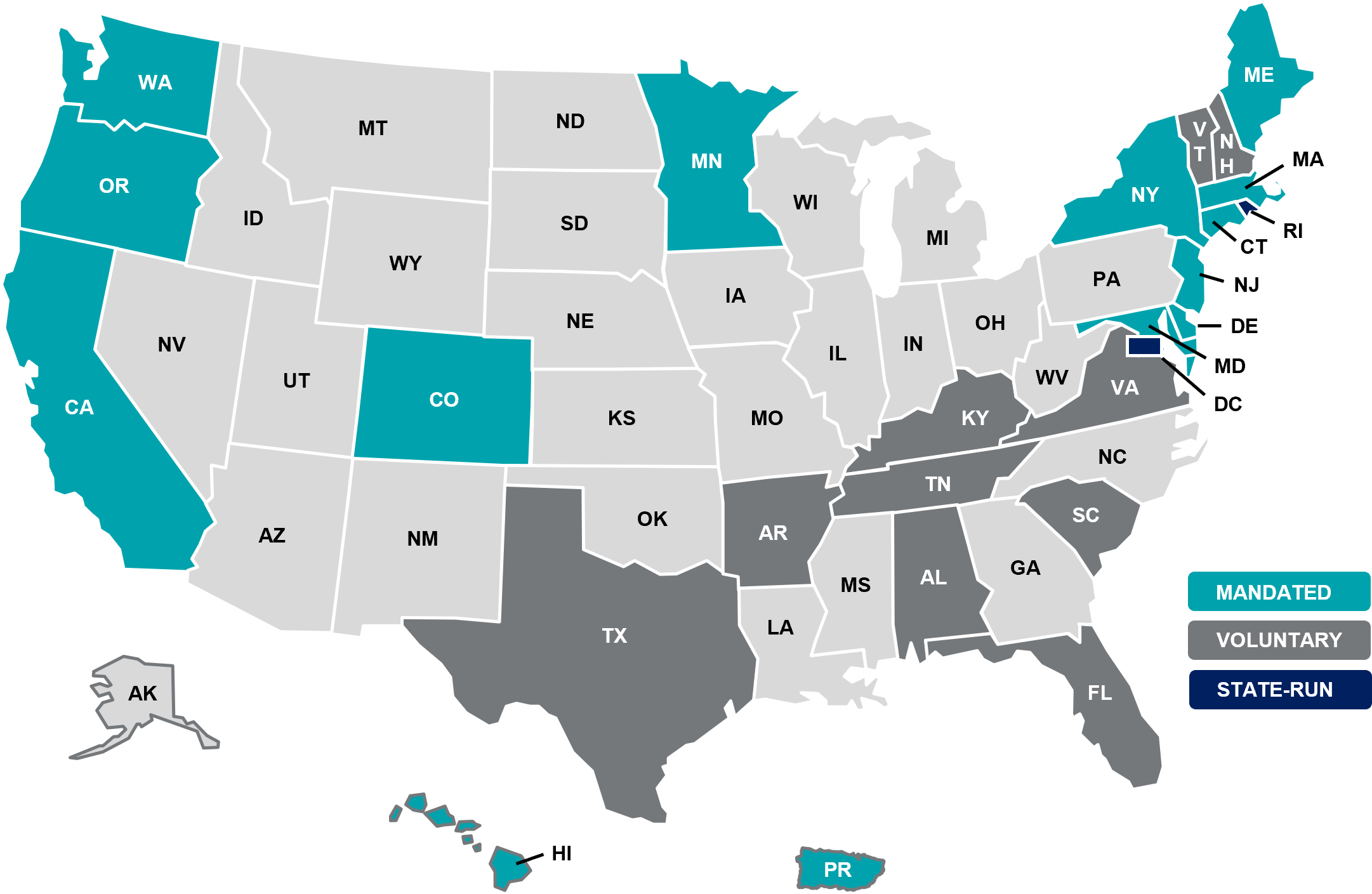

* These jurisdictions include, but may not be limited to, California, Colorado, Connecticut, District of Columbia, Hawaii, Massachusetts, New Jersey, New York, Oregon, Puerto Rico, Rhode Island, Washington (and Delaware and Minnesota as of 1/1/26, Maine as of 5/1/26, and Maryland as of 1/3/28).

Like most group disability insurance policies, MetLife policies contain certain exclusions, exceptions, waiting periods, reductions, limitations and terms for keeping them in force. Contact your plan administrator for details.

These policies provide disability income insurance only. For policies issued in New York, they do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Insurance Department. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future premiums that MetLife expects to return as benefits when averaged over all people with the applicable policy.

MetLife Group Disability Income Insurance is issued by Metropolitan Life Insurance Company, 200 Park Avenue, New York, NY 10166, under Policy Form GPNP23-2T DI.

The information presented in this website is not legal advice and should not be relied upon or construed as legal advice. It is not permissible for MetLife or its employees or agents to give legal advice. The information in this website is for general informational purposes only and does not purport to be complete or to cover every situation. You must consult with your own legal advisors to determine how these laws will affect you.