MetLife Retirement & Income Solutions

Macroeconomic Conditions Remain the Driving Force Behind De-Risking

Defined benefit (DB) pension plans provide long-term retirement security to millions of retirees. As companies seek to remove volatile and expensive pension liabilities from their balance sheets, they must ensure that pension benefits for their retirees are properly protected.

As a market leader that offered the first group annuity over 100 years ago, MetLife has been tracking pension risk management trends and developments for many years. The findings of the 2024 Pension Risk Transfer Poll reveal that macroeconomic conditions — rising interest rates, rising inflation and increased market volatility — are the driving force behind the elevated level of pension risk transfer activity in the U.S. today.

Download the 2024 Pension Risk Transfer Poll Infographic

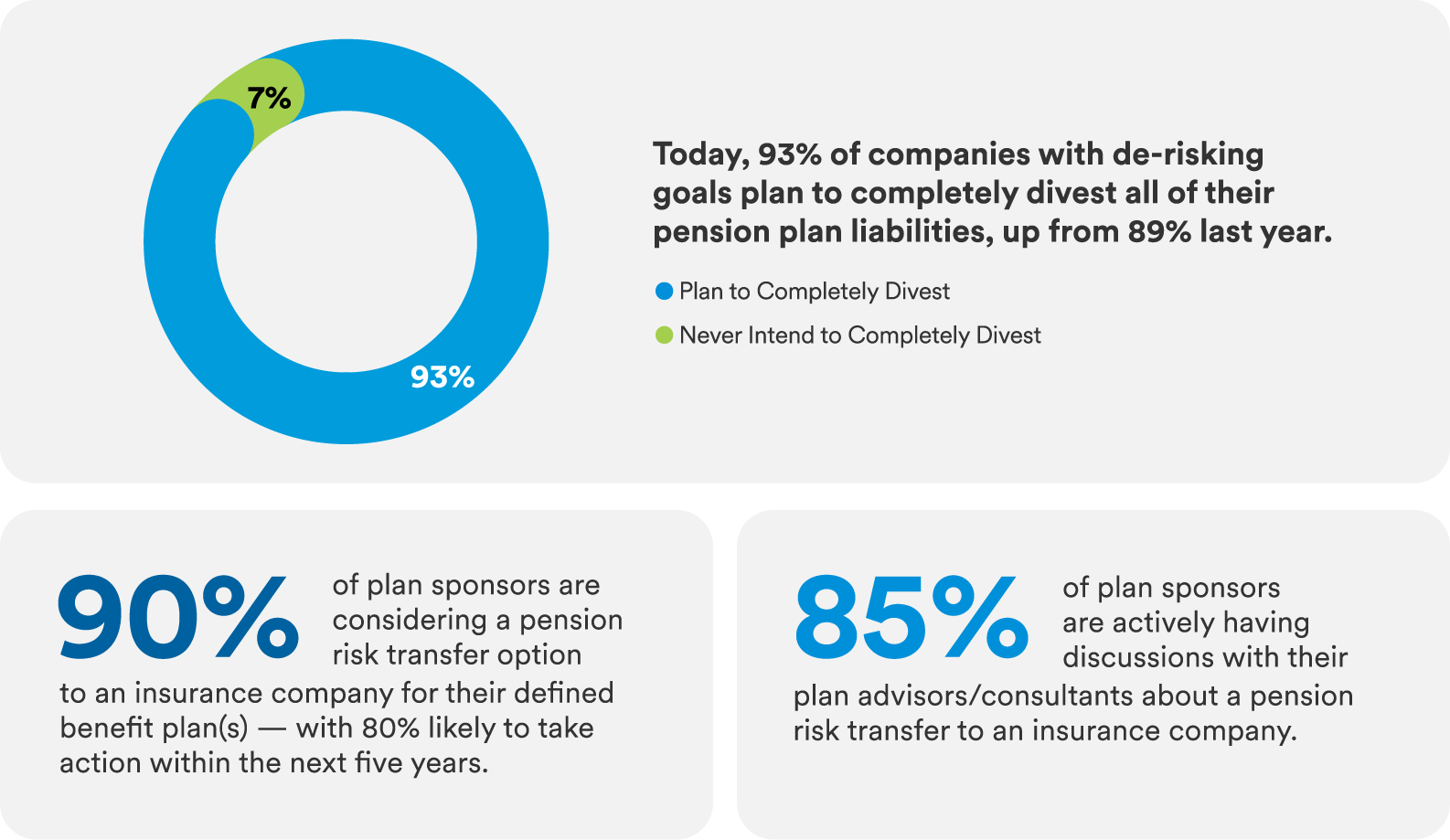

Pension Risk Transfer Activity Remains High:

On the heels of record-setting pension risk transfer sales in 2023, the high level of market activity will remain strong for the foreseeable future.

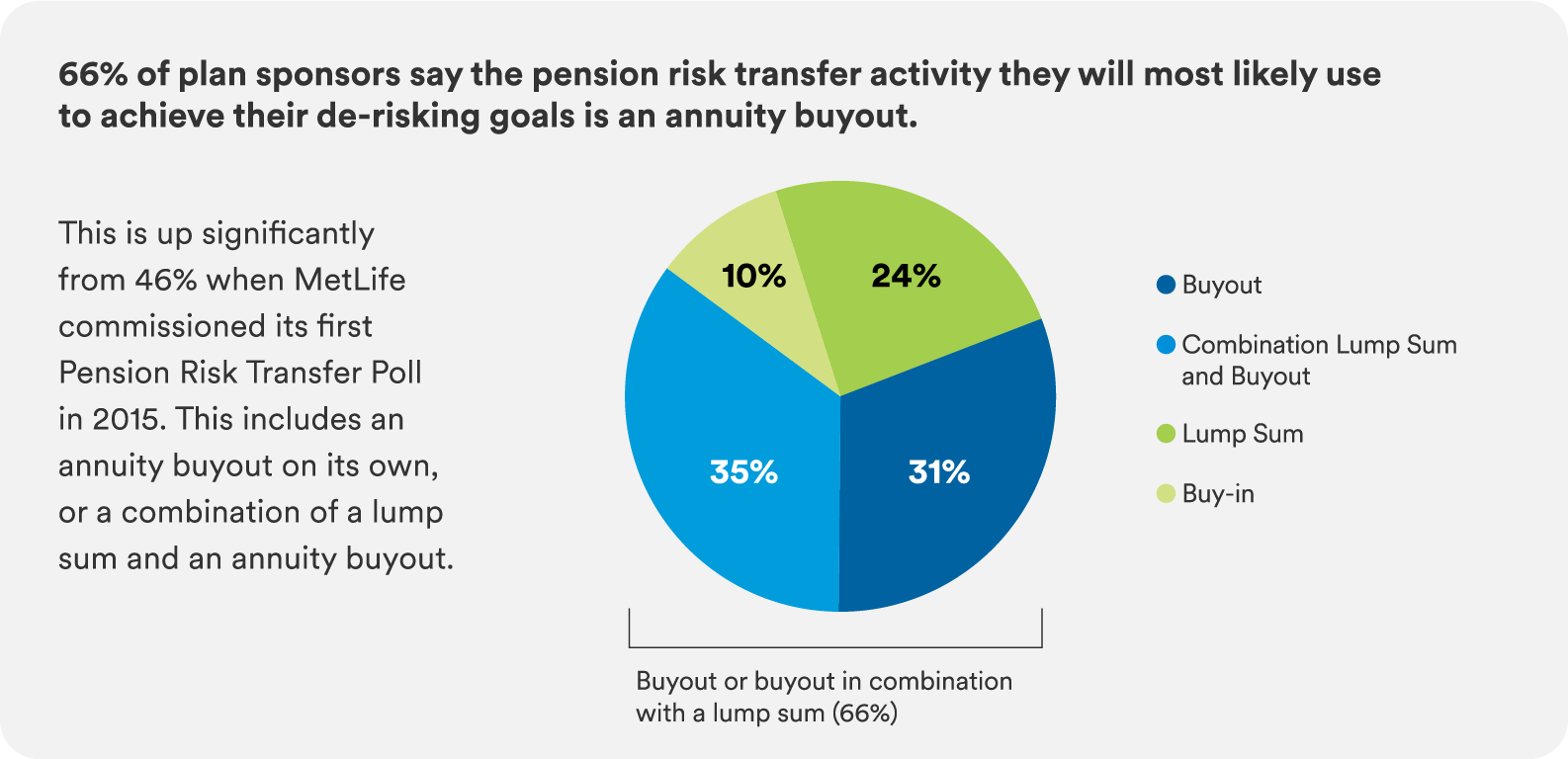

Annuity Buyouts the Most Desired De-Risking Strategy

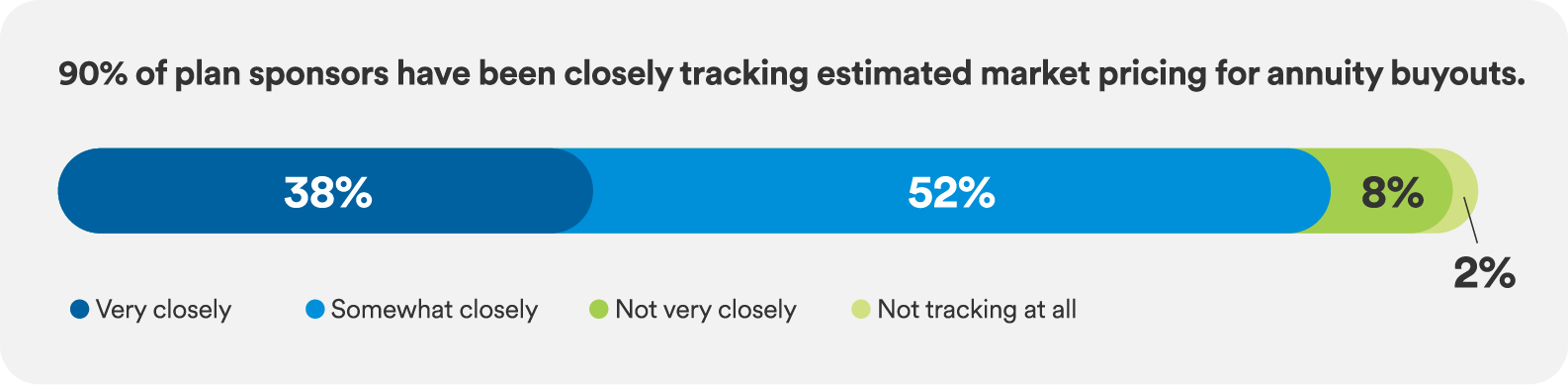

As another strong indicator of plan sponsors’ likelihood of engaging in pension risk transfer soon, many have been watching trends in market pricing for annuity buyout transactions.

Key Takeaways

- Most companies with de-risking goals will completely divest their pension plans.

- Current macroeconomic conditions remain the driving force behind de-risking.

- Plan sponsors are actively engaging in conversations about pension risk transfer.

- Annuity buyouts continue to be the most desired de-risking strategy.

- Buyouts for retiree lift-outs are most prevalent, especially for sizable transactions.

- Nearly all plan sponsors are closely tracking the cost of an annuity buyout.

- Financial strength of the insurer tops the list as the most important consideration.

Over a Century of Pension Risk Transfers

Since 1921, MetLife has worked with companies on their de-risking journey while providing retirees financial security.